Business Vehicle Depreciation 2024 Schedule – The wholesale prices car dealers pay for the used cars stayed essentially flat in January, a welcome sign of decreasing volatility in the auto market. . In olden days, your accountant would add $30,000 to your equipment schedule and, because the IRS tables say a mixer like that should last 7 years, he deducted $4,286 per year from income for 7 years .

Business Vehicle Depreciation 2024 Schedule

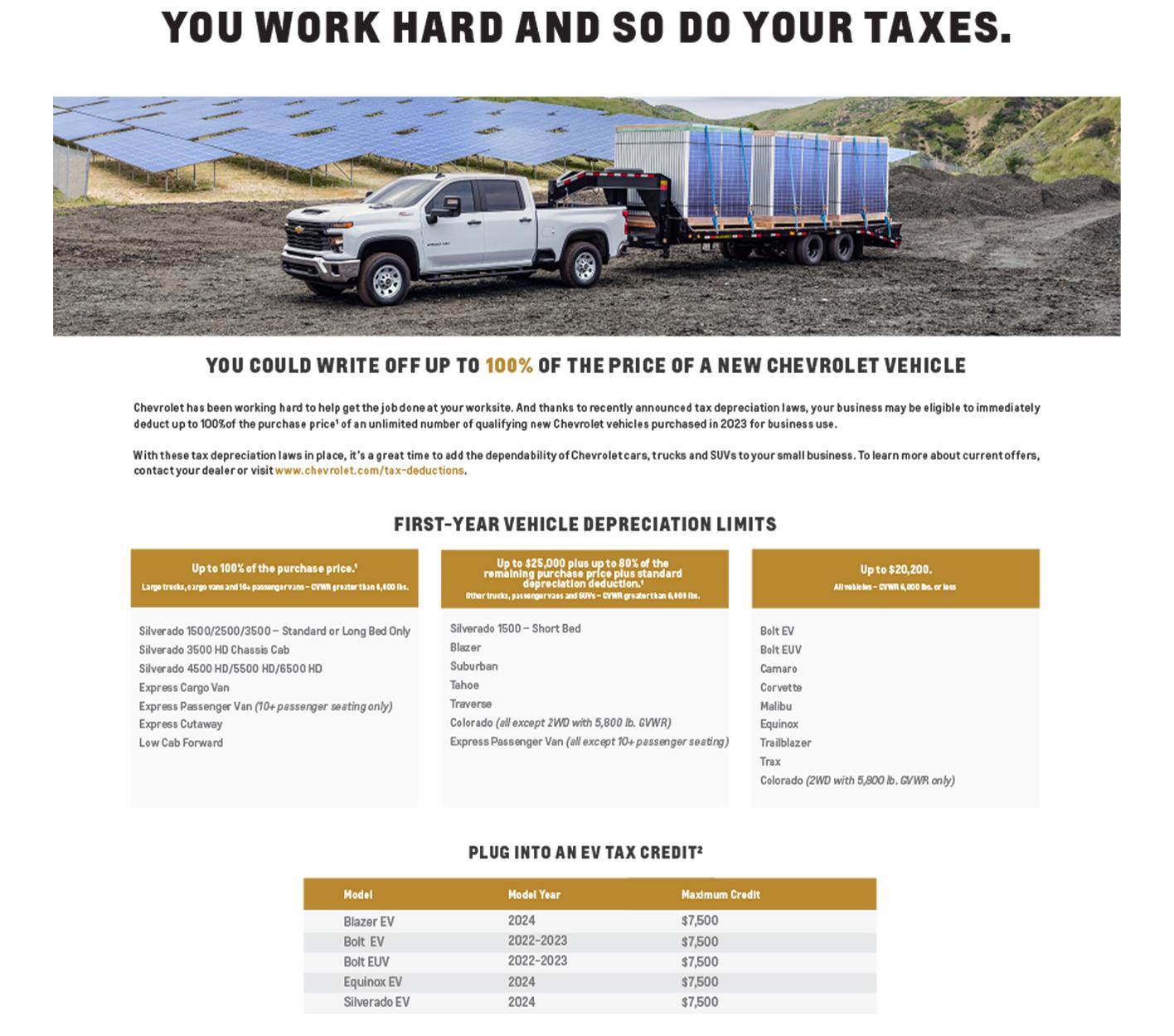

Source : www.jeep.comColussy Chevrolet is a BRIDGEVILLE Chevrolet dealer and a new car

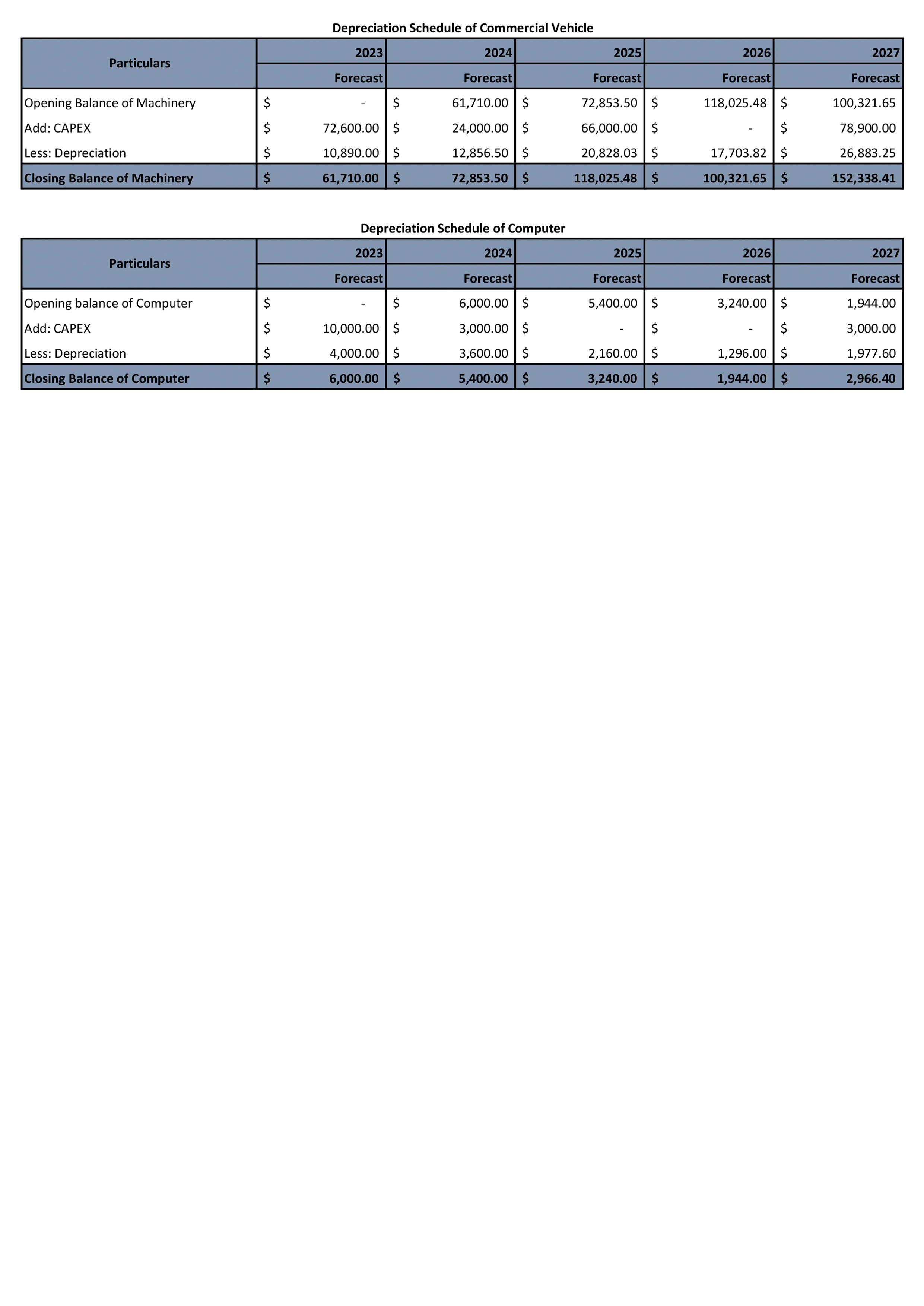

Source : www.colussy.comFinancial Statements And Valuation For Laundry And Dry Cleaning

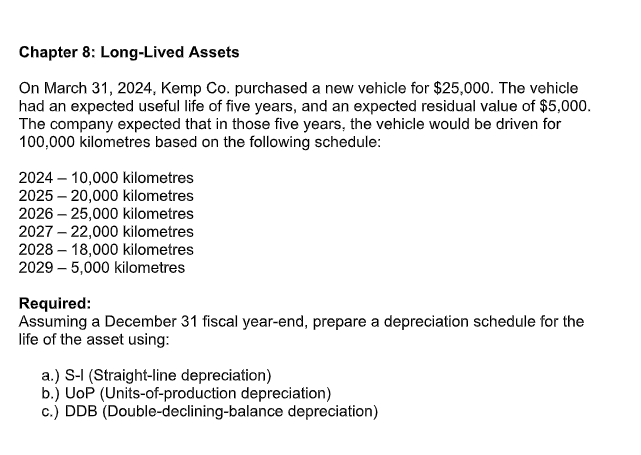

Source : www.slideteam.netSolved On March 31, 2024, Kemp Co. purchased a new vehicle | Chegg.com

Source : www.chegg.comBusiness Use of Vehicles TurboTax Tax Tips & Videos

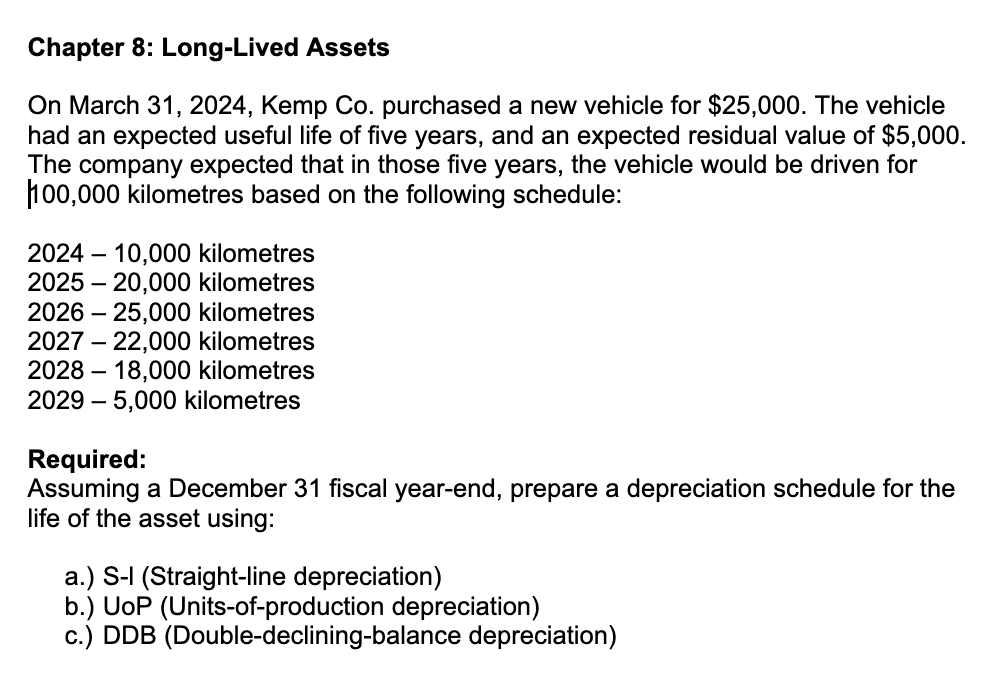

Source : turbotax.intuit.comSolved On March 31, 2024, Kemp Co. purchased a new vehicle | Chegg.com

Source : www.chegg.comLuxury Vehicle Business Tax Depreciation Advantage | Land Rover

Source : www.landroverlosangeles.comBlog Post List | Salem Ford

Source : www.salemford.netLuxury Vehicle Business Tax Depreciation Advantage | Land Rover

Source : www.landroverpasadena.comSection 179 & More Business Vehicle Tax Deductions | Jeep

Source : www.jeep.comBusiness Vehicle Depreciation 2024 Schedule Tax Benefits For Your Small Business With Jeep® Vehicles: Side hustles for drivers range from package and food delivery, to driving kids, adults and animals. Moreover, you can make money for doing your usual driving, while displaying a few advertisements on . A Uber driver had over $100,000 in gross income, but his profits fell to about $20,000 after expenses and commissions. .

]]>